As stated many times in this blog, the Class III price is the the basis for payment for most dairy producers, and the price of cheese is the driver for the Class III price. Unfortunately, cheese exports were down from the prior month and cheese imports were up.

It is not unusual for cheese exports to drop in April, so that can be expected. In fact, the 2018 April drop was less than the prior four years as shown in Chart I.

|

| Chart I - Cheese Exports |

|

| Chart II - Cheese Exports by country |

|

| Chart III - Cheese Imports |

|

| Chart IV - Cheese Imports by Country |

|

| Chart V - Cheese Net Exports |

|

| Chart VI - Cheese Inventory |

|

| Chart VII - Class III and Class IV Milk Prices |

NDM

What really did set records in April was Nonfat Dry Milk/Skim Milk Powder (NDM/SMP) exports (Chart VIII).

|

| Chart VIII - NDM Exports |

|

| Chart IX |

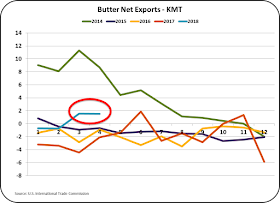

Very little butter is exported. Chart X below shows that the U.S. is now a net butter exporter. However, the numbers are very small. What butter is available is needed for domestic consumption. Butter exports were up in April, however, so were imports, leaving March and April net exports at the same volume.

|

| Chart X - Butter Net Exports |

Exchange Rates with international dairy competitors and customers show a strengthening of the USD against other currencies (Charts XI to IXV). A strengthening of the USD makes U.S. dairy products more expensive on the international market. To be competitive, U.S. dairy products must be sold at a lower price.

|

| Chart XI - Exchange Rates USD/Euro |

|

| Chart XII - Exchange Rates USD/NZD |

|

| Chart XIII - Exchange Rates USD/Mexican Peso |

|

| Chart IXV - Exchange Rates USD/CAD |

SUMMARY

By all the headlines, dairy exports are doing very well and setting records. More solids being exported do reduce the level of milk oversupply. However, exports of some products have much more of an impact on the milk price than other exports have. Cheese prices are linked closely with the milk price and therefore cheese exports are the most important. Cheese exports have not set an all time export record. A record level of cheese exports are needed to reduce the bloated cheese inventories.

No comments:

Post a Comment