The Trans-Pacific Partnership agreement (TPP) has been previously mentioned in this blog. On September 18 free trade agreements in general were discussed and the October 2 post discussed the maximum Somatic Cell Count allowed for the U.S. vs. international standards. Additionally, there is more information available in two of my recent articles published in Progressive Dairyman - Free Trade Agreements and SCC.

In this post I will review some of the published analysis material available on the TPP as it applies to the dairy industry. The TPP, if approved, will impact the dairy industry. To date the TPP has not been approved by congress. If the TPP is not passed, other forms of free trade agreements will no doubt be developed and approved. In general, by increasing competition, trade agreements typically reduce consumer costs, but they also create an environment that causes an industry to adjust. When adjustment occurs, some businesses gain and some businesses lose.

There has been a lot of study on the impact to various industries, and the information discussed here is generally available. The two most comprehensive documents are by the U.S. Agricultural Sector/American Farm Bureau Federation and the U.S. International Trade commission. They both depict a favorable impact from passage of the TPP. Exports would increase, domestic producer prices would increase, and there would be very little impact on imports.

The published data show an expectation of increased exports of $1.85 billion annually and increased imports of $427 million annually. The increase in exports will come primarily from Canada (60% of the increase) where the closed market will be opened to some dairy products. This would be a dramatic change for Canada, which has kept its dairy industry very closed to imports. The increase in imports would come primarily from New Zealand (60% of the increase) and would consist of mostly high-protein powders. The data does suggest that current limits on butterfat imports will be significantly increased, thereby increasing imports and reducing the price of butter. The other major assumption behind the data is that U.S. produced dairy products are generally lower priced than the international market, so few additional imports will occur. The studies were based on pricing data from the 2014 period when prices were very different than they are in 2016. In 2016, U.S. dairy prices are above international prices and imports have swelled.

Dairy product imports to the U.S. are kept at a minimum by the established two-tiered system where a limited amount can be imported at tariffs in the range of 10% to 25%. Above the first tier quotas, the tariffs increase dramatically to essentially eliminate further imports. By the terms currently in the TPP, the tariffs on the first tier quotas would be eliminated totally and immediately. The volumes allowed would be increased dramatically in many cases. For instance, New Zealand would be allowed to ship significantly larger volumes of cheese duty free to the U.S. The volumes allowed would continue to increase incrementally over 9 years, and would then be unlimited. In all, first tier tariffs are being eliminated for ten countries.

The changes are very different for U.S. dairy exports. Only Canada, Japan, and Malaysia are creating new TRQ's for imports of U.S. produced dairy products. In the case of Canada, quantities are very limited and phased in over 14 or 19 years and then fixed at those amounts. Similarly, exports to Japan are also very small amounts and are phased in over 12 years and then fixed.

In essence, the statistics are based on an expectation that U.S. produced dairy prices will be lower than international prices and imports will be restricted only by a lower U.S. price. In 2016, with the strong USD, the opposite is currently true. The only protection from massive imports has been the TRQ's

What is not covered in any analysis is the subject of volatility. The analysis described above was done at a time when U.S. imports were minimal and exports were growing nicely and prices were high. The year 2016 is not that kind of year. The year 2016 is an example of the volatility brought on by the huge swings in export/import volumes and international prices.

In 2008 to 2010, exports were impacted by swings in the exchange rates between the USD and the NZD. Producer prices went form $20/cwt. to $10/cwt. In 2015 and 2016, import/export volumes and prices were impacted by a very strong USD, a Russian embargo, a lifting of quotas in Europe and lower dairy imports in China. What is on the horizon next? Free trade agreements as defined in the TPP will certainly increase the volatility caused by international events.

The trade agreements are complex and involve many products. Any sector can be adversely impacted in exchange for other sectors, so it's very difficult to say if this trade agreement in total is "fair." The impact on the U.S. dairy industry, as analyzed by the U.S. International Trade Commission, appears to be slightly positive by the calculations provided, but there is a potential down side from international events and there will certainly be increased volatility. Dairy is a "different" business compared to many other industries. Producers are probably the most impacted. It's difficult to tell a cow "you're fired." Dairy production is capital intensive and individual countries like to be self-sustaining.

The key for producers seems to be maintaining a very low cost/high margin structure while learning to manage price volatility through financial tools such as hedging. Dairy processors use hedging extensively to manage volatility, but few dairy producers use hedging. Producers also need to manage not just to reduce costs, but also to manage to high margins. The industry is filled with examples of reduced costs, especially in feed, with the result that milk components are compromised resulting in net margin decline. Successful production management is much more complicated with the increasing free trade agreements and globalization. Those who survive must become sophisticated managers with good analytical analysis of their business and proper actions based on these analytics. The analytics must include national and international events as well as local herd events.

Sunday, October 16, 2016

Sunday, October 9, 2016

Prices Stabilize - Long-term Analytics Encouraging

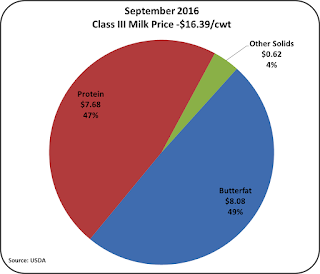

On October 5, September Class and Component Milk Prices were announced. The Class III milk price fell slightly to $16.39/cwt., a 3.1% loss. Milk protein prices held at $2.57/lb. while butterfat dropped 7.2% to $2.30/cwt. Other solids increased 24% to $.11/lb. on an increase in the value of dry whey.

The cheese prices fell slightly to $1.75/lb. but continued near the 2016 high point established last month. The price level for the last two months reflects a price not seen for cheese since January, 2015. The relatively stable cheese price and the lower butter price brought the current prices for components more in line with the long-term trends. Protein held its value while butterfat fell. Cheese prices are the primary determinant of the Class III milk price and butter prices shift value between butterfat and milk protein. The math behind these relationships was reviewed in the prior posts listed below.

"Is Milk Pricing really tied to Cheese Prices?"

"The Math behind Milk Protein and Butterfat Pricing"

The pricing for milk protein and cheese also brought the pie of components back to a more normal relationship with milk protein contributing 47% of the value to the Class III price. Butterfat retained its strong share of the pie chart, above historical proportions.

Nonfat dry milk prices were up 5% at $.89/lb., a high for 2016. This will increase the price of Class II and IV milk, but it is not enough to make it become the basis of the Class I milk price. The current price will increase the uniform price slightly and provide a higher Producer Price Differentials. While a lot of NDM was exported in August, it was sold at a low price, keeping the Class IV price well below the Class III price. For more detail on how NDM prices can be a major influence on Uniform milk price, see this prior blog post.

Imports and exports are the most volatile component of demand for U.S. produced dairy products. The most recent data on exports shows strong volumes of exports. However, exports in August were strong in volume, not dollars, and were driven by strong exports of NDM. A review of the data shows that exports of cheese and butter remained very low and the NDM was sold are low prices. While there has been recovery in overall export volume, it has not had an impact of the key items important to domestic dairy producer prices.

However, there is encouraging data in the developing prices of the key dairy exports. The higher U.S. prices for cheese and butter have made exports difficult and imports more attractive. While the dairy export and import volumes are always a month behind in availability, international prices are available almost immediately. The comparative pricing is encouraging. The international prices for cheese are at almost identical prices for Europe, Oceania, and the U.S. The price for SMP is also nearly equal for all the major competitors. Butter pricing is mixed as European butter has increased in price, but Oceania butter is still well below U.S. prices. That should play into improved exports and fewer imports. In all cases, the leveling of prices is a combination of lower U.S. prices and higher prices for the other international dairy exporters.

In addition to the lag in the data for exports and imports, there is an additional lag in the process for international purchases and shipments, there appears to be a developing competitive environment favorable to U.S. exports, but it will probably take the rest of 2016 to more fully develop. Given time, this should have a favorable impact on U.S. dairy prices.

CHEESE

Inventories of domestic cheese showed a favorable trend in August. After a build-up of cheese inventories in the first seven months of 2016, inventories fell a little in August. While this is normal pattern for August, it is a positive step toward bringing cheese inventories more in line.

There was also a reduction in cheese production in August which was also an encouraging analytic in reducing cheese inventories.

However, there was little help from exports/imports in August. Exports were down and imports were up resulting in a decline in net exports.

BUTTER

Butter inventories continue to remain high and prices continue to fall. Butter churning fell in August, but imports continued to grow. Butter is being imported in increasing quantities from Ireland, Mexico, and New Zealand.

SUMMARY

The market indicators are certainly mixed and that makes future pricing and timing difficult to access. There is an abundance of news that global dairy markets are correcting. However, there are still excesses that must be reduced before market forces are in balance. The futures market is predicting lower milk prices in the near future. The recovery that is starting to take place is progressing slowly. The impact of trade agreements and harmonization of global dairy standards presents another dynamic that is difficult to predict. (See the two prior posts - September 18 and October 2, 2016 - for some additional detail of trade agreements.) Overall, it appears that recovery of producer milk prices will be slow and volatile.

The cheese prices fell slightly to $1.75/lb. but continued near the 2016 high point established last month. The price level for the last two months reflects a price not seen for cheese since January, 2015. The relatively stable cheese price and the lower butter price brought the current prices for components more in line with the long-term trends. Protein held its value while butterfat fell. Cheese prices are the primary determinant of the Class III milk price and butter prices shift value between butterfat and milk protein. The math behind these relationships was reviewed in the prior posts listed below.

"Is Milk Pricing really tied to Cheese Prices?"

"The Math behind Milk Protein and Butterfat Pricing"

The pricing for milk protein and cheese also brought the pie of components back to a more normal relationship with milk protein contributing 47% of the value to the Class III price. Butterfat retained its strong share of the pie chart, above historical proportions.

Nonfat dry milk prices were up 5% at $.89/lb., a high for 2016. This will increase the price of Class II and IV milk, but it is not enough to make it become the basis of the Class I milk price. The current price will increase the uniform price slightly and provide a higher Producer Price Differentials. While a lot of NDM was exported in August, it was sold at a low price, keeping the Class IV price well below the Class III price. For more detail on how NDM prices can be a major influence on Uniform milk price, see this prior blog post.

Imports and exports are the most volatile component of demand for U.S. produced dairy products. The most recent data on exports shows strong volumes of exports. However, exports in August were strong in volume, not dollars, and were driven by strong exports of NDM. A review of the data shows that exports of cheese and butter remained very low and the NDM was sold are low prices. While there has been recovery in overall export volume, it has not had an impact of the key items important to domestic dairy producer prices.

However, there is encouraging data in the developing prices of the key dairy exports. The higher U.S. prices for cheese and butter have made exports difficult and imports more attractive. While the dairy export and import volumes are always a month behind in availability, international prices are available almost immediately. The comparative pricing is encouraging. The international prices for cheese are at almost identical prices for Europe, Oceania, and the U.S. The price for SMP is also nearly equal for all the major competitors. Butter pricing is mixed as European butter has increased in price, but Oceania butter is still well below U.S. prices. That should play into improved exports and fewer imports. In all cases, the leveling of prices is a combination of lower U.S. prices and higher prices for the other international dairy exporters.

In addition to the lag in the data for exports and imports, there is an additional lag in the process for international purchases and shipments, there appears to be a developing competitive environment favorable to U.S. exports, but it will probably take the rest of 2016 to more fully develop. Given time, this should have a favorable impact on U.S. dairy prices.

CHEESE

Inventories of domestic cheese showed a favorable trend in August. After a build-up of cheese inventories in the first seven months of 2016, inventories fell a little in August. While this is normal pattern for August, it is a positive step toward bringing cheese inventories more in line.

There was also a reduction in cheese production in August which was also an encouraging analytic in reducing cheese inventories.

However, there was little help from exports/imports in August. Exports were down and imports were up resulting in a decline in net exports.

BUTTER

Butter inventories continue to remain high and prices continue to fall. Butter churning fell in August, but imports continued to grow. Butter is being imported in increasing quantities from Ireland, Mexico, and New Zealand.

The market indicators are certainly mixed and that makes future pricing and timing difficult to access. There is an abundance of news that global dairy markets are correcting. However, there are still excesses that must be reduced before market forces are in balance. The futures market is predicting lower milk prices in the near future. The recovery that is starting to take place is progressing slowly. The impact of trade agreements and harmonization of global dairy standards presents another dynamic that is difficult to predict. (See the two prior posts - September 18 and October 2, 2016 - for some additional detail of trade agreements.) Overall, it appears that recovery of producer milk prices will be slow and volatile.

Sunday, October 2, 2016

Somatic Cell Count - Should the U.S. Accept the International Standard?

In the prior post this blog, free trade agreements were discussed. In that post, there was a link to an article on free trade agreements published in Progressive Dairyman by this author. Free trade agreements are in the headlines and gaining attention. Over time, dairy is becoming an international business. As mentioned in the prior post, one of the issues facing the U.S. dairy exporting efforts is the limit on Somatic Cell Count (SCC). There is a major difference between the U.S. and the other major dairy exporters that can and does inhibit exports. SCC levels are based on dead white blood cells that are fighting infection. A high SCC is typically from mastitis, an infection of the mammary gland. This post will examine the difference between the U.S. maximum limit on SCC vs. the maximum SCC limit of other major dairy exporters.

In simplistic terms, the maximum allowed SCC for Class A milk in the U.S. is 750,000 cells per milliliter. The European maximum is 400,000 cells per milliliter. The European maximum of 400,000 has been adopted by the other major dairy exporting countries and has become the de facto global standard. SCC is one of the major analytical parameters for measuring milk quality. In a comparison of the two parameters, U.S. milk would appear to be a lower quality milk. In European markets, dairy products produced by the U.S. cannot be imported. In other parts of the world, the high U.S. standard becomes a marketing disadvantage. One of the comments received from a UK producer and reader of the prior post stated, "SCC in the U.S. looks ridiculously high."

The maximum SCC of 750,000 is set by the U.S. Public Health Service/FDA. It is the required standard for Grade A milk. One of the arguments for the acceptability of the high standard is that there is no health risk with a high SCC. This standard applies to all milk produced in the U.S.

In the U.S., there are grocery chains that are contractually requiring milk to be well below the 750,000 cells per milliliter. The four Federal Orders in the middle of the U.S. pay a premium for SCCs below 350,000 cell per milliliter and charge a penalty for anything above 350,000. The Michigan Milk Producers Association has an additional bonus for milk with for SCCs below 250,000. Some dairy processors that export U.S. dairy products require that the milk meet the European standard for SCC. There are many more cases where a lower SCC is required or there are financial incentives for a lower SCC. Freshness, shelf life, taste, cheese yield, and cow productivity are some of the advantages cited for milk with a lower SCC.

There are significant differences in the calculation and method of enforcement between the European and U.S. standards. One difference is the sampling period and parameters for compliance to the maximum allowed SCC. In the U.S., bulk tank samples are evaluated monthly and if above 750,000 for three of the last five months, the milk will lose it's Grade A rating. When two of the last four are above 750,000, the producer is given a warning that if one more sample is above 750,000, the herd will lose it's Grade A rating. In the European system, a three-month geometric average is always used. If a producer averages above 400,000, they are placed on notice, but have three more months to get the rolling SCC geometric average below 400,000.

The U.S. uses individual monthly samples while the EU system uses a three-month geometric average. What is a geometric average? The geometric average is typically lower than an arithmetic average. For a detailed explanation of this mathematical difference and more detail on SCC, see my recent article in Progressive Dairyman.

The EU system does make it easier to meet their upper limit. A three month average minimizes the impact of a short time flare-up in SCC. The geometric average provides a lower value than a straight arithmetic average. The period for correction in the EU system allows three months after notice of noncompliance is given, where the U.S. require an improvement in the month following notice.

Dairy is becoming a global business. The U.S. dairy business already requires significant export volumes to prevent inventory buildup and resulting low prices. Therefore, the U.S. dairy industry must learn to comply with international standards. One option is to have two different standards; one for domestic milk and one for export milk with the export milk having a higher quality. This is probably not an acceptable situation. Accepting the international standard and three month geometric averages would require a significant change for some dairy producers. However, it seems to be the only reasonable alternative. A phase-in process would probably be required to allow producers with high SCCs to improve their management processes.

In simplistic terms, the maximum allowed SCC for Class A milk in the U.S. is 750,000 cells per milliliter. The European maximum is 400,000 cells per milliliter. The European maximum of 400,000 has been adopted by the other major dairy exporting countries and has become the de facto global standard. SCC is one of the major analytical parameters for measuring milk quality. In a comparison of the two parameters, U.S. milk would appear to be a lower quality milk. In European markets, dairy products produced by the U.S. cannot be imported. In other parts of the world, the high U.S. standard becomes a marketing disadvantage. One of the comments received from a UK producer and reader of the prior post stated, "SCC in the U.S. looks ridiculously high."

The maximum SCC of 750,000 is set by the U.S. Public Health Service/FDA. It is the required standard for Grade A milk. One of the arguments for the acceptability of the high standard is that there is no health risk with a high SCC. This standard applies to all milk produced in the U.S.

In the U.S., there are grocery chains that are contractually requiring milk to be well below the 750,000 cells per milliliter. The four Federal Orders in the middle of the U.S. pay a premium for SCCs below 350,000 cell per milliliter and charge a penalty for anything above 350,000. The Michigan Milk Producers Association has an additional bonus for milk with for SCCs below 250,000. Some dairy processors that export U.S. dairy products require that the milk meet the European standard for SCC. There are many more cases where a lower SCC is required or there are financial incentives for a lower SCC. Freshness, shelf life, taste, cheese yield, and cow productivity are some of the advantages cited for milk with a lower SCC.

There are significant differences in the calculation and method of enforcement between the European and U.S. standards. One difference is the sampling period and parameters for compliance to the maximum allowed SCC. In the U.S., bulk tank samples are evaluated monthly and if above 750,000 for three of the last five months, the milk will lose it's Grade A rating. When two of the last four are above 750,000, the producer is given a warning that if one more sample is above 750,000, the herd will lose it's Grade A rating. In the European system, a three-month geometric average is always used. If a producer averages above 400,000, they are placed on notice, but have three more months to get the rolling SCC geometric average below 400,000.

The U.S. uses individual monthly samples while the EU system uses a three-month geometric average. What is a geometric average? The geometric average is typically lower than an arithmetic average. For a detailed explanation of this mathematical difference and more detail on SCC, see my recent article in Progressive Dairyman.

The EU system does make it easier to meet their upper limit. A three month average minimizes the impact of a short time flare-up in SCC. The geometric average provides a lower value than a straight arithmetic average. The period for correction in the EU system allows three months after notice of noncompliance is given, where the U.S. require an improvement in the month following notice.

Dairy is becoming a global business. The U.S. dairy business already requires significant export volumes to prevent inventory buildup and resulting low prices. Therefore, the U.S. dairy industry must learn to comply with international standards. One option is to have two different standards; one for domestic milk and one for export milk with the export milk having a higher quality. This is probably not an acceptable situation. Accepting the international standard and three month geometric averages would require a significant change for some dairy producers. However, it seems to be the only reasonable alternative. A phase-in process would probably be required to allow producers with high SCCs to improve their management processes.

Subscribe to:

Comments (Atom)