The prior two posts covered the lack of growth in milk demand and slowing sales of fluid milk, cheese, and butter. This post will show why retail sales of dairy products are slowing down demand for producer milk. As will be shown below, retail prices of the major dairy products has escalated tremendously in 2022. Fluid milk is a necessary buy in many households, but competition from nondairy "milk" is hurting sales. The downturn in fluid milk sales has been going on for decades and there seems to be no slowdown in this trend. Cheese and butter are not a necessary buy. If prices go up, there is elasticity of demand and there has been huge retail price increases in 2022 causing a decrease in retail purchases. This is why there is a downturn in milk demand!

Retail prices used in this post are from the Bureau of Labor Statistics (BLS).

FLUID MILK

As covered in the prior post, fluid milk sales increased in 2020 as the "stay at home" mandates required workers to stay at home, and they probably ate more cereal with milk. Retail milk prices increased from the 2018 average price of $2.90 per gallon to a high of $3.31 per gallon in 2020, a 14% increase. With the sudden change in eating habits, that is understandable. But after the mandates were dropped, the prices did not drop back to 2018 levels but kept growing. The average price in 2022 was $4.09 per gallon, another 23% higher. The inflation in fluid milk prices over five years is 41%!

There is some slight moderation of prices in 2023 with a drop in retail fluid milk prices of 4% vs. the prior year.

During this time, Class I milk prices ranged from $1.73 in 2018 to $2.75 in 2022 an increase of 59%.

The decreasing consumption as covered in the

prior post shows an annual decrease of consumption of slightly over 2%, which is where it has been in prior years. There is very limited price elasticity of demand in fluid milk. User will buy regardless of the price.

|

| Chart I - Retail Fluid Milk Prices per Gallon |

|

| Chart II - Annual Retail Price Changes in Percent's |

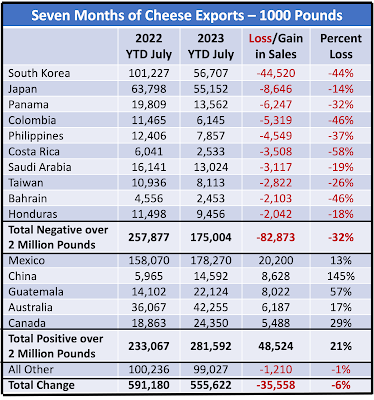

CHEESE

Cheese is a very different story. Average cheddar cheese prices increased by 15% in 2022. The volume of disappearance from wholesale inventories in 2022 (as a leading measure of consumption) decreased by 6%. That is elasticity of demand. As prices go up, sales go down. The price of cheddar cheese peaked at $6.08 per pound, a record high.

|

| Chart III - Price per Pound for Cheddar Cheese |

|

| Chart IV - Retail Price Changes in Percent's |

In 2021, the average price of Class III milk for cheese was $17.08 per cwt. In 2022, the average price was $21.96 per cwt., a 29% increase. In May 2022, the Class III price peaked at $25.21 per cwt., a record high.

BUTTER

Average butter prices in 2021 were $3.59 per pound. In 2022, the average price jumped to $4.38 per pound, a 22% increase. On a month-to-month basis, from January 2021 to January 2022, retail butter prices increased from $3.67 per pound to $4.88 per pound, a 33% increase and

a record high. These were major price increases and as covered in the

prior post, domestic withdrawals from wholesale inventories dropped by 8% reducing the demand for butterfat. There is price elasticity of demand for butter and as prices climb, sales decrease.

Chart V - Butter Retail Prices

|

| Chart VI - Retail Price Changes in Percent's |

The increases in the Agricultural Marking Service (AMS) butter prices used to price producer milk increased by 22% during the short interval between January of 2022 to October of 2022. The AMS butter price reached a record high in October 2022 of $3.19 per pound.

THE BOTTOM LINE

A quick take on the analytics above shows that the high producer revenues in 2022 brought the retail price increases and thereby dampened consumption and the demand for milk. All the numbers above are very volatile and have been influenced by COVID lifestyle changes followed by inflation.

By comparison, the overall consumer price index (CPI) is now 3.7% for the last 12 months and the food CPI is 4.3%. Both increased in August, the most current data. However, all the CPI statistics are much smaller than the BLS retail price increases of dairy products discussed above. Dairy producer prices have always been volatile. The BLS retail dairy prices listed above indicate that retail dairy price levels are being tested and changed regularly to ensure good revenue at the retail level.