Cheese and butter exports are down significantly. This is contributing to the downturn in demand for producer milk. Cheese exports are down less as a percentage than butter exports. Data used in this post is based on July YTD data for 2023 compared to the same period in 2022.

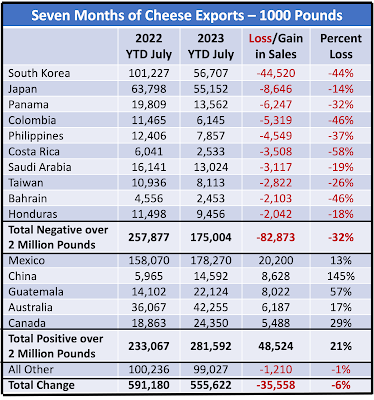

Table I below shows where the cheese exports are down and where they are up. Overall, through July 2023 exports of cheese are down 6%. Previously cheese exports were growing. There have been major decreases in imports from many countries. The largest major loss was in cheese exports to South Korea. South Korea has been the second largest importer of U.S. cheese, and their imports are down by 44% in 2023. Japan has been the third largest importer of U.S. cheese, and their purchases are down 14%. Listed below are many other countries with lower purchases. In total, for the 10 countries listed below, exports to date are down 32% which amounts to nearly 83 million pounds of cheese.

The losses in cheese exports to the listed 10 countries is partially offset by increases from other countries. The largest of these is Mexico where imports are up 13% over the prior year. The 20 million pounds increase helped offset a lot of the losses from other countries. China has more than doubled their imports of cheese. The five countries with the biggest increases in exports are listed below and together increased purchases of cheese by 49 million pounds.

The overall cheese exports are down 36 million pounds in the first 7 months of 2023. The volume of cheese exported declined from 7.1% of cheese production in 2022 to 6.7% in 2023. That reduced the need for producer milk by 3,600,000 cwt.

|

| Table I - Changes in Cheese Exports from 2022 to 2023 YTD July |

|

| Table II - Changes in Butter Exports from 2022 to 2023 YTD July |

No comments:

Post a Comment