The COVID-19 pandemic and quarantine measures implemented to reduce the pandemic impact have turned the entire world into something different from normal operations. Because everything is different now than it has ever been, it is sometimes hard to understand where the dairy industry is and where it is going. This post will cover a few of the impacts that are turning dairy pricing into a mystery. The following items will be discussed:

- The impact on Class I milk sales: Some recent articles have suggested that consumption of fluid milk has increased. This is not true.

- The impact on the pricing of the different Classes of milk: Why is Class I down, Class III up, and Class IV much lower than Class III.

- The impact on the June Producer Price Differential (PPD): There is a perfect storm of events to make the PPD go negative. The price of cheese was at a low point when the Class I price was calculated for June and it was at a high point when the Class III price was calculated. The new Class I formula is also playing a part in making the PPD negative

- The impact on de-pooling: As the PPD goes negative, de-pooling occurs. De-pooling at this time of volatility is potentially greater than ever before.

Some of the COVID-19 impacts were covered in the prior two posts.

One June 1, the post

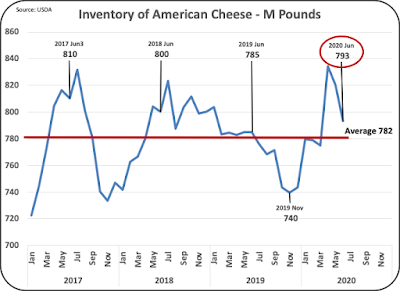

"Key Cold Storage Cheese Inventories Swell - When Will Inventory Levels Normalize?" reviewed the impact of losing food service to restaurants.

On June 22, the post "

Cheese and Butter Prices Skyrocket. Is it Realistic? Maybe not!" covered cheese inventories, production, disappearance, imports, and exports.

CLASS I FLUID MILK PRODUCTION

There have been numerous reports in the press that fluid milk consumption has increased during the pandemic. Unfortunately, that is "fake news." Chart III shows the Class I milk produced in 2018, 2019, and through May of 2020. In 2019, the amount of Class I milk was lower than the prior year for every month. Overall, the 2019 Class I milk was four percent lower than the prior year.

In 2020 there was a significant spike in March, however, Class I volume fell too much lower levels in April and May. The high of March can be contributed to increasing consumer stockpiling and hoarding. Fluid milk has a very short shelf life, so much of what was probably hoarded was probably wasted. Some of the March excess may also have contributed to lows of April and May. This pattern was the same for each Federal Order. Class I milk cannot be de-pooled, so the accuracy of the data from the Federal Orders is very accurate.

|

| Chart III - Class I Fluid Milk for Drinking. |

PRICING of MILK CLASSES I, III, and IV

Chart I illustrates the timing of Class I and Class III pricing. The June Class I pricing was determined by the Advanced pricing method based on data for the weeks of May 9 and 16 when cheese prices were low. The Class III price is based on the Class and Component method for the weeks of June 6, 13, 20. and 27 when cheese prices were high.

|

| Chart I - Advanced Pricing vs. Class and component Pricing |

During April and early May, the NASS cheese price dropped to a low of $1.12 per pound. However, in the following weeks it increased by over 100 percent as shown in Chart II. Because the Class I price is announced before the month starts, the Advanced price for Base Class I was very low at $11.42 per cwt. The Class I Advanced price is based on the Class III and IV advanced skim prices and The Class III portion is primarily based on the cheese price. For the Advanced pricing cheese was valued at $1.19 per pound.

By the end of the month, the cheese price used in the Class III Class and Component pricing had jumped to $2.22 per pound, nearly double that used for calculation of the Class I milk. The Class and Component pricing model is based on four weeks of NASS statistics shown below in Chart II..

|

| Chart II - NASS Cheese Price by Week |

The PPD

The PPD was designed to ensure that all producers were paid equally regardless of the usage of their milk. It is calculated as the difference between the Class III price which is the initial milk payment to processors and the weighted average of the four Classes of milk call the Uniform price. Historically, significant increases in the cheese price have resulted in a negative PPDs due to the timing of the Class I pricing and the Class III pricing as explained above. In June, the price increases for cheese were extreme.

As of May 2019, the formula for Class I pricing was changed to included Class IV pricing in the formula. The old and new formulas are shown below. The change was made to allow processors to more precisely hedge pricing by eliminating the uncertainty in the old formula which could use Class III or IV. (See the

January 12, 2020 post to this blog for an analysis of this change.)

OLD FORMULA

Base Skim Milk Price for Class I =

Higher of Advanced Class III or Advanced Class IV Skim Milk

Pricing Factors

NEW FORMULA

Base Skim Milk Price for Class I =

((Advanced Class III Skim Milk Pricing Factor + Advanced Class

IV Skim Milk Pricing Factor) / 2) + $0.74

This formula change brought more certainty to the milk processors but brought another factor into milk pricing for producers.

Class IV Skim pricing is based the price of Nonfat Dry Milk (NDM). The price of NDM is shown in Chart III. NDM is primarily an export product and prices are set based on global markets.

|

| Chart III - NASS weekly prices for NDM |

There has been significant press about a potentially large negative PPD for June. The amount of the PPD varies significantly from one Federal Order to another as shown in Table I below. PPDs for June 2020 are not yet available, but when they are, they will be reported here. Table I shows the negative PPDs that occurred in November 2019. They ranged from -$.94 in the Upper Midwest to -$3.30 in California. In November of 2019, cheese increased in price by $.23 per pound from the Advanced pricing timing to the Component pricing timing. This June, the cheese price increased by $1.03 per pound from the Advanced pricing to the Component pricing. The June PPDs will therefore be significantly larger than those shown below for November 2019.

|

| Table I - PPD in November 2019 |

Comparing this June to November 2019, the following PPD issues shown in Table II come into play. The arrows show the upward increases to higher PPDs and the downward arrow shows the downward impact to a lower PPD.

|

| Table II - Changes in parameters effecting PPDs and De-pooling |

The individual June PPDs for each FMMO will be announced within the next ten days and will be covered in the blog.

DE-POOLING

When the PPD becomes negative, there is an advantage to de-pooling for those who can de-pool. De-pooling does not really create more producer money, but it does spread it around differently, Those who de-pool make more and those who are left in the pool make less. The total does not significantly change. Below in Table II is a very simplified example. Note that with de-pooling, the PPD becomes increasingly negative.

|

| Table II - Payments Change with De-Pooling |

With the expected very large negative PPD in June, maximum de-pooling will take place. In the Upper Midwest in November 2019, Class III milk usage dropped from 90% of total milk in the pool to 68% of milk in the pool as a lot of Class III milk was de-pooled. In June at least this amount of de-pooling will probably occur.

SUMMARY and FORECAST

Exactly how June PPDs and de-pooling analytics result for each Order will be known soon. Clearly June PPDs and de-pooling will be greater than the negative PPDs and de-pooling of November 2019 cited above. For instance, one economist pegged the negative Upper Midwest PPD at between a negative $1.30 per cwt and negative $8.11 per cwt., a very broad range.

Class and Component prices for June were announced today, July 1, 2020. The Class III standardized price was $21.04 per cwt. and the cheese price was $2.21 per pound. It should be noted that the most current NASS weekly cheese price is $2.45 per pound suggesting that cheese and Class III prices could still be increasing. July Advanced pricing was based on prior weeks and used average cheese prices at $2.02 per pound. This could mean that July will likely be another month of negative PPDs and de-pooling.

The pandemic and all the changes surrounding the pandemic have thrown the world into uncharted territory. The U.S. dairy industry is no exception.