July cheese prices published in the NASS weekly surveys continue to climb ito record highs. However, cheese inventories as of the end of June do not show any shortages or low inventories. This is a very unusual pattern. In this post the newest analytics influencing cheese and milk prices will be examined. Cheese cold storage inventories are available through June. Other data relating to inventory movements are available only through May.

- NASS cheese prices for the first three week of July are averaging $2.53 per pound. This is record high, well above all 21-year historical levels.

- If the July cheese and butter prices remain at the levels of the first three weeks, milk protein will reach a historical high of over $5.50 per pound.

- End of June cheese inventories are still above averages.

- Cheddar cheese is the benchmark for cheese pricing. Cheddar cheese production is "normal."

- Cheddar cheese inventory levels are not publicly available. However, Cheddar cheese makes up most of the category known as "American" cheese. In June, "American" cheese inventories are still above average. There is no apparent shortage of Cheddar cheese as of June 30.

- "American" cheese disappearance from inventories did strengthen in May. It has helped lower "American" cheese inventories some, but they are still above average.

Cheese prices are the most significant parameter for dairy producer pricing. The data for NASS cheese pricing is collected and published weekly. The cheese prices used for Class and Component Pricing are collected for four-or-five-week periods and averaged. July Class and Component prices will be based on five weeks of data. There are currently three weeks of the five weeks period published. The three weeks suggest that the July Class and Component cheese price will rise to new historical highs. Chart I shows the current three weeks of July cheese prices and the pricing trends for 2019. The first three weeks cheese prices average $2.53 per pound. The cheese price used for the July Advanced pricing was $2.02 per pound. This continuing escalation of cheese prices as well as continuing low Class IV prices will keep the PPD strongly negative in July.

|

| Chart I - 2019 NASS Weekly Cheese Prices |

How high would a cheese price of $2.53 per pound be? Chart II below shows the history of NASS cheese prices for the last 21 years. The June Class and Component price for cheese was $2.22 per pound. The highest ever cheese price was $2.35 per pound in 2014. If the current three-week average for July of $2.53 per pound holds up, July would be up 14 percent higher from the prior month and eight percent higher than the all-time high. The July price of cheese will likely be at a record well above anything in the past 21 years.

Chart III shows the level of total cheese inventories. While May and June inventory levels are down from the April highs, the inventories are still substantial and higher than the two-and-a-half-year average. The two-and-a-half-year average amount of cheese in cold storage is 1,369 million pounds. As of the end of June 2020, the level of cheese inventory in cold storage is 1,416 million pounds, three percent higher than the average.

|

| Table III - Total Cheese Inventory |

Cheese prices as announced are really based on Cheddar cheese prices which is the chosen benchmark for all cheeses. Cheese prices are typically dependent on the level of cheese inventories. When inventories are high, prices are low, and when product is scarce, prices are high. Cold storage inventories of Cheddar cheese are not publicly available, however "American" cheese inventories are available and Cheddar cheese makes up 72 percent of "American" cheese production.

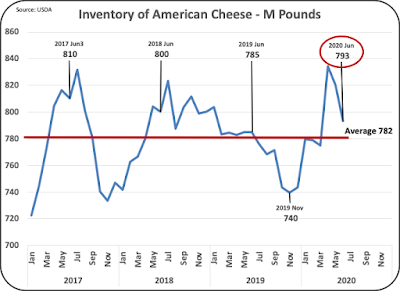

By the end of June, "American" cheese inventories were down considerably to 793 million pounds (Chart IV). That is only slightly higher than the prior three years of June inventory levels which averaged 798 million pounds. Cheddar cheese is not a growth product and therefore "American" cheese inventories fluctuate, but do not grow over time as Chart IV shows. The total average of "American" cheese inventory during the last three and a half years was 782 million pounds. The current inventory level of 793 million pounds is just slightly higher than the average for the last three and a half years. There does not appear to be a shortage.

The June 30 cheese inventory level of 793 million pounds does not even come close to a record low inventory level that would support a record 21-year high cheese price as described above. In late 2019 "American" cheese inventory levels went to 740 million pounds, which resulted in a high cheese price of $2.17 per pound, which is not even close the pending $2.53 per pound cheese price discussed above.

The CFAP plan which has been in place since May 15 may be having some impact on lowering "American" cheese inventories, but it has not yet lowered cheese inventory levels to the point of having a shortage which would normally trigger high prices. The inventory data in Chart IV represents June 30 levels which is 45 days since the CFAP plan was implemented.

|

| Chart IV - American Cheese Inventory |

Production of Cheddar cheese also remains robust through May 2020. Chart V shows the production of Cheddar cheese in May at 319 million pounds, 3 percent higher than the average of the last three-and-a-half-years. This level of production should keep Cheddar cheese inventories adequate.

|

| Chart V - Production of Cheddar Cheese |

One of the other important parameters is cheese disappearance from cold storage. In May "American" cheese disappearance reached above average levels, an encouraging sign. April disappearance was unusually low as the U.S. adjusted to more in-home dining and less eating out. The supply chain therefore had to adjust supplies from food service to retail sales of cheese. The Coronavirus Food Assistance Program (CFAP) had been in effect for only two weeks at end of May but may have also had an impact. More will be known in a few weeks when June detail is available.

|

| Chart VI - American Cheese Disappearance |

SUMMARY

The data in the charts above do not show the typical relationships. When cheese inventories are above normal, it is very unusual to see high cheese prices typically associated with inventory shortages. One of two things will have to happen. Either the disappearance of cheese will need to jump drastically by the demands of the CFAP plan or other means, or the Cheddar cheese price will have to fall.

As the Covid-19 pandemic continues to upset normal dairy pricing relationships. The continuing impact will be reviewed regularly in this blog.

No comments:

Post a Comment