What makes U.S. per capita cheese consumption change? In the

July 26 post to this blog, we examined the link between recessions and changes in cheese consumption. Upon review of the history of recessions and cheese consumption, there is

no indication that people eat less cheese in a recession than at other times.

However, in 2008 and early 2009, cheese consumption did decrease significantly. This post examines the link between cheese consumption and cheese prices. Is there price elasticity? As cheese prices increase, does demand slacken? As cheese prices decrease, does demand increase? The graphs below indicate that there is in fact price elasticity of demand. When the prices move up significantly, the growth in per capita cheese consumption goes down.

The biggest increase in cheese prices in the last 30 years occurred in 2008. Cheese consumption actually decreased from 2007. This same pattern has occurred other times over the last 30 years.

This clearly shows that when milk prices increase to historic highs, retail cheese prices will follow and consumption will take a hit.

Many things caused the 2008/09 dairy economic disaster.

- A strengthening of the USD caused U.S. cheese to be expensive on the global market and exports decreased.

- A weak New Zealand dollar made New Zealand cheese "cheap" on the global market and U.S. imports increased.

- U.S. retailers increased cheese prices dampening consumer demand for cheese.

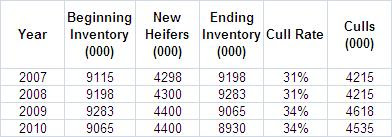

- The U.S. Dairy industry increased the number of cows significantly and brought milk production to all time highs. This was at a time when demand for U.S. cheese was decreasing.

The chart below shows the consumer price index for cheese from 1980 through September, 2009. The 2008/09 bubble can be clearly seen. As of mid 2009, cheese prices are back to their historical pricing levels.

Examining the last three years more closely (the area in the box on the above graph) we can clearly see the bubble and the current pricing. The current pricing should bring cheese consumption back to normal growth levels if historic relationships prevail.

There are two important lessons to learn from this.

- Very high milk prices will lead to very high cheese prices and demand will fall.

- Cheese consumers are sensitive to cheese prices and will reduce consumption with a significant increase in prices.

The U.S. dairy market is on it's way to recovery. In previous posts we have established that the Dairy business is global and influenced by global factors. In a global market, the low cost producer will win. Low cost milk protein is the key to low cost cheese.

Which cheese demand factors are the most important? The import/export markets or U.S. consumption? The comparison will be made in an upcoming post to this blog.