The effort to change the California producer milk payment system to a Federal Order started in 2015. Recent events on the path to California becoming a Federal Milk Marketing Order include the following:

- February 14, 2017 - The USDA published their recommendation

- February 22, 2017 - The USDA held a meeting to explain in detail their recommendation

- February, 2017 - Regulatory Economic Impact Analysis of the recommended California FMMO was published by AMS

- May 15, 2017 - Deadline for comments on the USDA proposal

- February to May - Various meeting have been held to review and discuss the proposal

This blog post will examine some of the key points in the AMS published "Economic Analysis of the Recommended California FMMO." Their analysis covers not just the impact on California, but covers the impact on the pricing and production of all U.S. milk.

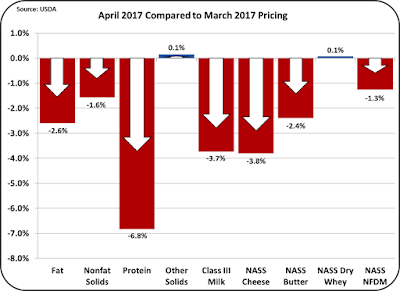

As a Federal Order paid on components, California producers will be paid based on pounds of milk protein, pounds of butterfat, and pounds of other solids. The change in values of these components will impact not only California producers, but all U.S. orders paid on the component system. By the AMS projections, milk protein will increase in value by $.47/lb. Based on current values, that would mean an increase of slightly more than 25%. Butterfat would fall in value by $.26/lb. and other solids would increase by $.03/lb.

LESS CALIFORNIA CHEESE

The AMS reasons behind these significant component changes are based on changes in the class composition of California milk. The largest use of milk in California today is for making cheese (Class III milk). In 2016, 47% of California milk went to cheese making. Because California milk for cheese will be more expensive when priced by FMMO formulas, it will be less competitive. As a result, less cheese will be made in California. With less cheese made in California, the total cheese made in the U.S. will drop, causing cheese inventories to shrink and prices to increase. Higher prices for cheese translate into higher prices for milk protein for all orders.

MORE NONFAT DRY MILK AND BUTTER

That leaves some California milk available for other uses. By the AMS analysis, that milk will be used as Class IV milk for butter and nonfat dry milk processing. Because more butter will be available, the price of butter (and therefore butterfat) will drop. That will reduce butter imports and increase butter exports. But, the real impact for milk pricing caused by the increased volume of Class IV pricing, will be to reduce the price of nonfat dry milk and butter. The additional nonfat dry milk will have to find a home in the international markets. If all other factors remained constant, that would mean a decrease in the value of nonfat dried milk.

By the Federal Order formulas, a lower butter price will also impact the price of milk protein. By the formulas used, when butterfat is more valuable when used in cheese rather than butter, the value of milk protein goes up. That is part of the reason for the significant price increase in milk protein.

LESS DRY WHEY

The AMS impact on Other Solids pricing comes from supply and demand for dried whey. With lower cheese production, less whey will be available for drying and therefore the price of dry whey will increase.

What does the AMS not take into account? Currently, much of the California milk used for cheese receives an above minimum bonus for milk protein levels above threshold levels. Will these private incentives for protein production be revised? Cheese producers in other Federal Orders like the Upper Midwest pay similar bonuses for higher protein levels. It is likely that bonuses for protein production in California will be revised to be competitive with bonus plans in other orders. Public information on these bonuses is not available as they are based on private business arrangements between producers and processors.

CALIFORNIA PRODUCER PRICE DIFFERENTIAL

If California becomes a FMMO, producers will also receive a Producer Price Differential. The Producer Price Differential is based on the difference between the uniform milk price, a weighted average of the four milk classes, and the Class III price. Producer Price Differentials are calculated individually for each order paid on components. The California producer price differential is not specifically covered in the AMS model. In theory, with reduced Class III California milk and a significant increase of lower priced Class IV milk production, the California FMMO uniform price would be close to the Class III price and sometimes below the Class III price, minimizing the producer price differential. It may at times cause the producer price differential to be negative.

However, California Class II, III, and IV milk can be de-pooled in California when it becomes a Federal Order. De-pooling was not allowed under the California pricing system. De-pooling allows the producers milk to not be included in the FMMO pricing program. Producers typically de-pool when the producer price differential is negative. The de-pooling does not impact the price of nonfat dry milk used for pricing Class IV skim milk, because the price is determined by international supply and demand. However, the de-pooling will impact the volume of Class IV milk used in the calculation of the uniform price. If the Class by Class volume changes are as forecast by the AMS model, the producer price differential for California will be minimal.

For more detail on the AMS economic impact report see my recent article in Progressive Dairyman - and the AMS Economic Impact document.

By background, the following articles may also be useful:

- Deadlines Approaching on California FMMO Proposal, Voting - May 1, 2017 - David Natzke

- Decision Time: USDA 'recommends' California join FMMO - February 13, 2017 - David Natzke

- California as an FMMO - February 12, 2017 - John Geuss

- Clock still ticking on California Order - February 7, 2017 - John Geuss

- California vs. FMMO Milk Pricing - March 11, 2016 - John Geuss