Butterfat and protein prices returned to their more traditional relationship with protein valued higher than butterfat.

To emphasize this, protein and butterfat are shown below in a simplified graph. It is unusual for butterfat to be valued higher than protein, but through the last part of 2010 and in January, 2011, the shortage of butter drove up the price of butter and butterfat to unusual highs. The February prices reflect a return to more traditional values.

Butter production is starting to show improvement in early 2011. The January production of butter was the highest in two years.

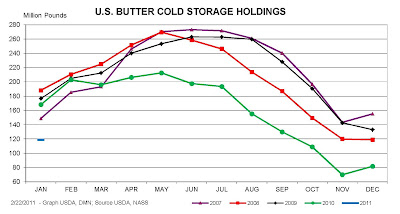

The increased production is impacting butter stocks which have rebounded slightly in 2011.

The yearly chart of butter stocks is also shown below to emphasize that while production and stocks have improved, there is still a long way to go to reach anything near normal levels. (Note the 2011 value at 118 thousand pounds.)

Butter prices did not reflect any decrease in February, but they can be expected to decrease with an improvement in butter stocks.

Cheese prices and inventories remain in what appears to be an imbalance. Cheese inventories remain high. This is reflected in both the charts below. While the inventories are no longer growing, they are also not decreasing. This is reflected in the total natural cheese stocks as well as the American cheese cold storage holdings.

- One analyst stated that the increase is due to the cheese industry deciding to hold higher inventories,

- another analyst stated that the cheese inventory is reflecting additional cheese aging,

- and another analyst believed that the higher inventories result from the NASS survey technique which add and deletes suppliers. His explanation is that the survey has added more new locations than they have deleted.

As long as the inventories remain high, the price of cheese could decline. As we know from previous posts to this blog, there is a very tight correlation between cheese prices and Class III milk prices.

While there is uncertainty in milk prices, the fact remains that Class III milk prices for February are a welcome improvement and the March and April Class III futures are even more robust, currently above $19/cwt.

Exports are very strong and as the world recovers from the recession, there is strong hope for a significantly improving outlook for dairy prices. With that statement, if the U.S. is to be a world class dairy competitor, then it must run the lowest cost operations with the highest quality while serving the needs of the International market.

There are always new challenges, but there is also no doubt that the U.S. Dairy systems is adapting to these needs.