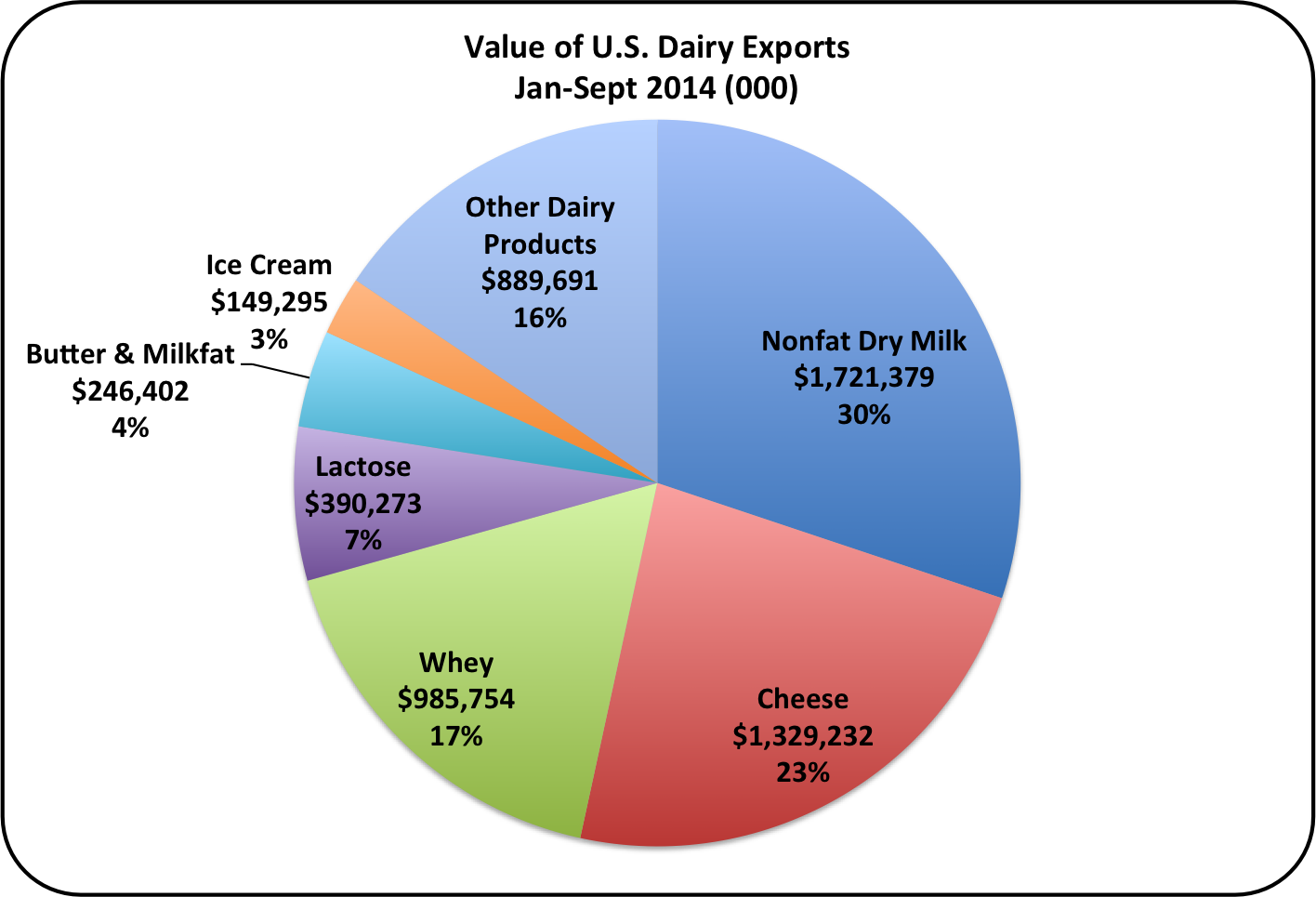

To put things in perspective, the pie chart below shows the values of export categories for the first nine months of 2014. They total 5.7 billion dollars and account for 15.5% of the U.S. dairy production.

Nonfat Dry Milk is the largest category in USD, and has a much larger share in tons exported. In 2013, the U.S., for the first time, became the world's largest exporter of Skim Milk Powder/Nonfat Dry Milk, exporting 555 thousand metric tons. The chart below shows the other SMP/NDM exporting countries. The EU and New Zealand are major exporters of SMP/NDM, and competitors for this business in the international markets.

For the first ten months of 2014, the U.S. has exported 469 thousand metric tons of SMP/NDM. To match 2013's volume level, the U.S. would have to export 43 thousand metric tons in November and December. Exporting that level is still possible, but for the last two months, the U.S. has been below that level. In October, there was a slight gain in exports, so recovery may be in process to meet the 2013 record export levels.

Prices for SMP/NDM have fallen internationally. International prices are important because to date, 54% of the U.S. SMP/NDM have been exported. The Export price closely matches the domestic price. As shown in the chart below, the U.S. has held prices above the EU and Oceania, but that higher pricing is hurting export volumes. With higher prices export volumes will not recover, domestic inventories will increase, and domestic prices will fall. On the other hand, if prices are lowered on exports, domestic prices will also fall. Either way, a domestic price decline is likely.

Cheese is probably the most important product to review. This is because the price of cheese, as determined by NASS, is the major variable in pricing milk. Cheese exports have more than doubled in the last five years and now account for 7.4% of production. However, that export volume is declining. If volumes continue to decline, it can quickly bloat domestic inventories and hurt domestic prices. Traditionally, Mexico is the largest export customer for the United States. In October, Mexico's imports fell 16% from their 2014 running rate and South Korea became the largest export customer. This may be a short-term situation, but bears watching.

The biggest export drop was in butter. The all time high volume of butter exports occurred in March 2014 with over 12,000 metric tons exported. This depleted domestic inventories and caused historically high butter prices. In October, just over 2000 metric tons were exported. This should certainly allow domestic stocks of butter to recover. For a view of butter stocks over the last six years, click here.

Currently butter prices are declining and are expected to fall further. This fall will bring butter prices more in line with long-term trends. As long as churning capacity is not increased, the U.S. cannot be a major butter exporter. For a view of butter prices, click here.

Dry Whey is the fourth and final commodity, which directly influences producer prices. To date, 60% of the dry whey produced has been exported. Exports remain strong, and dry whey prices are maintaining the level of 2014 prices. As a result, the price paid producers for "Other Solids", which is based on the dry whey price, also remains healthy.

There is one other market of interest, because it is a developing market for the U.S. Whole Milk Powder (WMP) does not have a market in the U.S. This is due to adequate refrigeration of fluid milk, excellent logistics for fluid milk delivery, and consumer buying habits. WMP is strictly an export market, dominated by one major buying customer, China. Production and inventories have varied tremendously. However, WMP exports, while small, are the strongest growing U.S. export item. WMP exports are up 46% YTD. Recently the market has cooled off and exports are tracking at last year's level. U.S. exports of whole milk powder are only about 10% of those for SMP/NDM. This is a market of high risk, but it is the largest export category globally and penetrating it could have big returns.

EXCHANGE RATES

Exchange rates are adversely impacting dairy exports. The strongest impact is vs. the Euro. This comes at a time when Europe's dairy industry is concerned about over production as a result of the recently implemented Russian embargo. The European dairy industry needs to export more dairy products and a weak Euro helps them accomplish this.

The NZD has also weakened against the USD, helping New Zealand export their dairy production.

The EU and New Zealand are the two largest dairy exporters, and represent strong competition to the U.S. The strong USD gives these competitors a pricing advantage.

CONCLUSIONS

Producer milk prices, as predicted in the CME futures market, show prices falling by 1/3 from the 2014 highs in the next few months. Cheese prices, which are the primary basis for milk prices, are similarly priced. This assumes a continuing drop in cheese exports that will bloat domestic inventories and cause prices to drop. An examination of cheese exports in detail doesn't support this. The long-term best customer for cheese is Mexico. In October, their imports were off, causing them to be the "second best" customer after South Korea. We do continue to see increasing U.S. cheese exports in many other parts of the world, notably in the Far East counties.

Exports to Mexico, that have dropped in the last few months, are not reason enough to expect a long or even a short-term trend of decreased exports to Mexico. While the future is always uncertain, exchange rates between the Mexican Peso and the USD have shown only a slight strengthening of the USD. It would therefore be reasonable to expect exports to Mexico to increase to the prior higher levels. With the strengthening of cheese exports to other parts of the world and a recovering market in exports to Mexico, a stable to increasing level of cheese exports is not unreasonable. With that would come strengthening prices for cheese and milk.

As for SMP/NDM, lower prices continuing well into 2015 are reasonable. The contribution of the high SMP/NDM prices in 2013 and early 2014 were the basis for a nice addition to milk prices, but not of the magnitude of cheese prices, so their impact should be less.