This post will examine the recently released data on domestic consumption of dairy products. The data used in this USDA report is based on similar methodology used by the monthly milk sales report and the monthly milk disappearance report.

In total, the results reflect the following.

- Fluid milk consumption continues to fall at a rate slightly above two percent annually.

- Yogurt consumption continues to fall at a rate near two percent annually.

- Ice cream consumption is declining. In 2018, consumption dropped over five percent.

- The rates of decline for fluid milk and yogurt appears to be slowly accelerating.

- Butter consumption is increasing near two percent annually. Much of this growth is captured by imports butter led by imports of Irish butter.

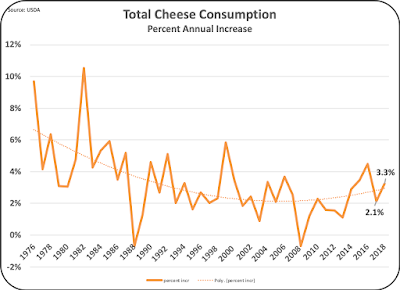

- Cheese consumption is increasing at a rate of three percent annually, above the historical rate increase of two percent annually.

- With all products summed, the report shows a slight increase in the "fat equivalent" milk required to meet domestic consumption. Butterfat production per cow is increasing above historical levels, meaning that fewer pounds of milk are needed for the equivalent amount of butterfat and because milk per cow continues to increase by above one percent per year, fewer cows are needed every year.

All charts below show annual changes on a per capita basis and on a total basis. All data in this post reflect calendar year analytics for all years from 2000 through 2018.

The change in total annual growth or decline of dairy consumption reflects the slowing growth in the U.S. population. Chart I shows the percentage change by year in the U.S. population growth. The population growth influences the amount of milk needed for production and consumption of dairy products. In 2018, the population increased by just .6 percent. Twenty years ago, the population was increasing by over one percent annually. While the population is still growing, the growth rate is getting smaller.

|

| Chart I - Annual Population Growth in the U.S. |

Fluid milk consumption changes are shown in Charts II and III. They reflect the same decline in milk consumption reported in the most recent post to this blog that contains data for the first half of 2019. Fluid milk sales have been falling for decades and are currently falling much faster than previously in both per capita consumption and total consumption. The current rate of total milk decline is slightly over two percent annually.

|

| Chart II - Annual Percent Change in Per Capita Consumption of Fluid Milk |

|

| Chart III - Annual Percent Change in Total Consumption of Fluid Milk |

Yogurt had positive but declining increases in consumption between 2000 and 2013. Since 2013, yogurt consumption has been declining every year. Charts IV and V show how yogurt consumption has decreased on both a per capita basis and a total basis. The rate of decline is increasing and is currently around two percent shrinkage annually.

|

| Chart IV - Annual Percent Change in Per Capita Consumption of Yogurt |

|

| Chart V - Annual Percent Change in Total Consumption of Yogurt |

Ice Cream is also a declining category (Charts VI and VII). Per capita consumption has been falling for decades and now total consumption is also declining. Total ice cream consumption fell over five percent in 2018.

|

| Chart VI - Annual Percent Change in Per Capita Consumption of Ice Cream |

|

| Chart V - Annual Percent Change in Total Consumption of Ice Cream |

Cheese is the brightest spot in consumption of dairy products. Charts VIII and IX show the growth of cheese on a per capita basis and a total consumption basis. Cheese consumption had been growing at about a two percent annual rate, but for the last four years, that rate has increased to a three percent annual growth level. There is price elasticity of demand for cheese, so lower prices for producer milk and therefore lower prices for cheese may be driving the increased growth. If so, with higher producer milk prices, cheese prices will increase, and growth will likely return to the two percent level.

|

| Chart VIII - Annual Percent Change in Per Capita Consumption of Cheese |

|

| Chart IX - Annual Percent Change in Per Total Consumption of Cheese |

Butter is another growth area for dairy (Charts X and XI). Butter consumption is growing by about two percent. However, as discussed in the August 15 post to this blog, a significant amount of this increased demand is being met with imported butter, especially Irish butter from Ireland.

|

| Chart X - Annual Percent Change in Per Capita Consumption of Butter |

|

| Chart XI - Annual Percent Change in Total Consumption of Butter |

SUMMARY

The USDA per capita consumption data summarizes the demand for milk based on a "fat equivalent" basis often known as "fat corrected" milk. "Fat equivalent" is straight forward approach to summarizing the needed supply of milk. The USDA data is based on the actual annual fat levels of producer milk, which in 2018 were at 3.9 percent of total milk.

The percent change in the data is shown in Charts XII and XIII. The charts show a long-term increase of over one percent annually and a 2018 total milk increase of about one percent. That would indicate that some expansion in the milk supply is needed annually to meet consumption trends. The 2018 increase in the needed milk supply is well above the prior year which was at .3 percent.

The 2018 increase in the needed milk supply is clearly lead by the above current increases in cheese consumption. A drop from the current annual growth rate of three percent in cheese consumption to historical levels of two percent would reduce the needed milk supply significantly.

|

| Chart XII - Annual Percent Change in the Milk Supply Needed to Meet Consumption |

|

| Chart XIII - Annual Percent Change in the Milk Supply Needed to Meet Consumption |

Cow productivity in pounds of milk per cow continues to grow at the historical rate of over one percent per year as covered in the July 25 post to this blog. With the increased milk productivity per cow, there is no need for an annual increase in cows.

Exports of dairy products appear to be stalled. To reduce the still high inventories of cheese, the milk supply needs to be have negative growth for the short-term to bring cold storage inventories in line.

No comments:

Post a Comment