The Agricultural Marketing Service (AMS) weekly prices are showing stability. Changes in the first quarter of 2023 have lower, but stable prices. This post will update the February 12 post on the most recent prices from the AMS weekly surveys. These wholesale commodity prices are used to price most of the U.S. producer milk. There are four commodities used to price milk in the Class and Component Federal Orders; butter, cheese, nonfat dry milk (NDM), and dry whey.

Butter prices were very volatile beginning in 2020 through 2022. In 2023, prices have settled in at levels slightly above those in 2018 and 2019. Since the beginning of 2023, butter prices have ranged from $2.41 to $2.49 per pound, far below the 2022 high of $3.24 per pound and in a very tight range. Inventories appear to be at a reasonable level as covered in the prior post. The year 2023 has brought stability to wholesale butter prices.

|

| Chart I - Butter Weekly Wholesale Prices |

|

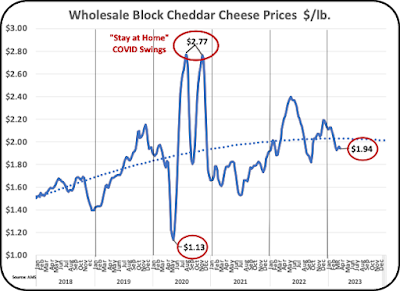

| Chart II - Block Cheddar Cheese Weekly Wholesale Prices |

|

| Chart III - Barrel Cheddar Cheese Weekly Wholesale Prices |

|

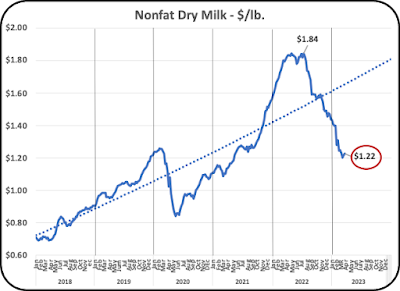

| Chart IV - NDM Weekly Wholesale Prices |

Dry whey is used to price the components other than butterfat and protein in milk (Chart V). As described in the prior post, about half of dry whey is used domestically and the rest is exported. The prices in 2023 have been very consistent, ranging from $.40 to $.45 per pound. Inventory levels are reasonable. The lower prices are showing stability.

|

| Chart V - Dry Whey Weekly Wholesale Prices |

SUMMARY

What do all four commodities have in common? They have all fallen from their 2022 highs and most are reaching stable pricing. The first quarter of 2023 is nearly closed, and it is a time where pricing has returned to the past with stability in pricing.

NDM prices are very low compared to historical trend lines and may have some upward movement in the remaining three quarters of the year. To date there are no upward trends.

Can producers live with these lower prices? If not, the recent increase in milk production may be short lived.

No comments:

Post a Comment