Producer milk prices are based on the wholesale price of four dairy commodities: butter, cheese, nonfat dry milk (NDM), and dry whey. The Agricultural Marketing Service does a weekly survey of these wholesale commodities. At the end of the monthly period, those survey results are combined to calculate the price for butterfat, milk protein, and "all other" for Class III milk and Class IV skim milk. The monthly periods are based on 4-week and 5-week averages.

Following the weekly surveys can provide an accurate prediction of month end prices for the milk solids listed above.

________________

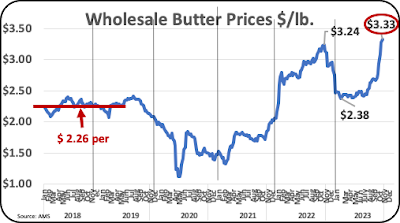

Butter prices are hitting record levels. In early 2023 butter prices fell significantly, reaching a price of $2.38 per pound. In the most recent weekly survey, butter prices hit a record high of $3.33 per pound. The previous high for a month was $3.19 per pound in October 2022. If a whole month was valued at $3.33 it would result in a producer price of $3.82 per pound for butterfat, which would be a record high.

|

| Chart I - Wholesale Weekly Butter Prices |

Clearly, maximizing butterfat production should be a top priority for milk producers. Butterfat prices have been on a decades long increase. With a trend that long, there is no reason to not take advantage of the record setting current prices. See the prior post on the increased levels of butterfat in milk.

_________________

Cheese prices are key to Class III skim milk prices. Milk protein is the major component in pricing Class III skim milk. Unfortunately, as butter prices rise, milk protein prices decrease. The formulas for protein pricing were also covered in the prior post.

The current weekly price of $1.71 per pound is not a bad price and is near historical prices. The 24-year average price for cheese is $1.82 per pound. Over the course of Chart II below, the average price was $1.80 per pound.

|

| Chart II - Wholesale Weekly Cheese Prices |

Cheese prices have shown relatively limited growth over the last 10 years as shown in Chart III.

|

| Chart III - Cheese Prices Over the Last 10 Years |

There is little reason to expect a major change in cheese pricing.

_________________

Other Solids are priced based on the price of dry whey. Their contribution to overall producer milk pricing is minimal. Currently, prices are relatively low. Dry whey is a byproduct of cheese making and must be sold at prevailing domestic and international prices. The supply of whey is only dependent on the volume of cheese production and must be sold at the current prices.

|

| Chart IV - Wholesale Dry Whey Prices |

_________________

The remaining commodity is NDM. It's pricing is used to price Class IV skim milk and in turn is also used to price Class II skim and partially price Class I skim. The market is primarily international sales with sales to Mexico, a valuable customer.

The current price of $1.16 per pound is close to the 6 years average price of $1.17 per pound for the period shown in Chart V._________________

In summary, the commodity that is exhibiting the best price and the best price growth is butter. As a result, the milk solid to emphasize is butterfat. As mentioned in the prior post there are many techniques to increase butterfat. Balancing amino acids is one technique that can also improve milk protein and cow health.

No comments:

Post a Comment