Fluid milk consumption continues to drop. Cheese consumption continues to expand. The question is, how much milk will be required to fulfill the needs? This post will examine where U.S. cheese consumption and production is going. Cheese is the most important growth product that can give milk producers an increasing demand for milk.

The data for this post comes from the OECD, the Economic Co-operation and Development organization headquartered in Paris, France. They collect a great deal of economic data from the 38 member countries and provide forward looking forecasts. In the data below, the UK is shown separately from the EU because they are no longer a member of the EU.

Using this data provides insight into U.S. consumption and production of cheese and provides comparative data from other countries. The object of this post is to quantify how the growth of cheese demand in the U.S. is developing. Domestic consumption and net exports make up the total demand for cheese.

The EU is by far the leader in cheese production and consumption. The population of the EU is about 448 million people, about 35 percent bigger than the U.S. Per capita consumption of cheese is 20 percent greater in the EU compared to the U.S. That should leave significant growth opportunities for U.S. cheese consumption.

CONSUMPTION OF CHEESE

Chart I is a pie chart of the cheese consumption in the OECD countries. The EU is by far the largest consumer of cheese. Their market for cheese is very well developed and is still growing. However, the rate of growth is slowing as the market for cheese matures. The U.S. is the second highest consumer of cheese. The EU and the U.S. account for 84 percent of the OECD cheese consumption. Consumption of cheese by the other 36 countries is much smaller.

|

| Chart I - OECD Countries Cheese Consumption |

The growth in cheese consumption is shown in Chart II. The EU and UK markets are very mature and are expected to increase by less than one percent annually. The U.S. is a slightly less mature market for cheese. Although the growth rate in the U.S. is also slowing, it is still expected to grow at about 1.5 percent annually.

|

Chart II - Cheese Consumption Growth of the

Largest Consuming Countries |

The U.S. exports cheese primarily to three countries. They are Mexico, Japan and Korea in that order. The growth of consumption in these three countries is about two percent annually, only slightly greater than the cheese consumption growth in the U.S.

Will the U.S. cheese export market diminish with increased local cheese production in these countries? The OECD data does not indicate any change in cheese production in Mexico, Japan, or Korea.

Total cheese exports amount to about six percent of U.S. cheese production and have not been increasing. Therefore, exports will not have a significant bearing on cheese demand.

Based on this data, cheese consumption and exports in the U.S. are expected to grow at about 1.5 percent annually in the upcoming years.

PRODUCTION OF CHEESE

Chart III which shows production of cheese by country is very similar to Chart I which shows consumption of cheese. The EU and the U.S. make up 86 percent of cheese production in the 38 OECD countries. Production of cheese by the other 36 OECD countries is much smaller.

|

| Chart III - OECD Countries Cheese Production |

Production of cheese in the U.S. (Chart IV) is currently growing by over two percent annually, but that is expected to fall to about 1.5 percent in the coming years, consistent with cheese consumption covered above. EU cheese production growth is also slowing down to about one percent growth in coming years which is also consistent with expected EU consumption rates and exports.

The UK is expected have no growth in cheese production in the coming years. Much of the cheese consumption in the UK is fulfilled with imports. See Table I near the end of this post.

|

Chart IV - Cheese Production Growth of

Major Cheese Produce |

OTHER FACTORS

Will some of the other OECD countries capture some of the current U.S. export business or bring imports to the U.S.?

The U.S. is exporting about six percent of cheese production but in terms of net exports (exports minus imports), the balance between production and consumption is only four percent (Table I). Net Cheese Exports from the EU are 11 percent by comparison. The UK imports a very significant amount of cheese to meet their consumer demand.

|

Table I - Production and Consumption of the

Major Cheese Countries

|

Canada limits cheese imports to support cheese production in Canada. In-turn cheese consumption and production in Canada are about equal and will not impact the demand for U.S. produced cheese.

Australia and New Zealand are major exporters of their cheese. However, both have had issues with milk and cheese production. New Zealand is limited by land mass, which their forage model is dependent on. Their switch to crossbreeds is somewhat expanding their milk supply. There are no major changes indicated in the OECD data that suggests that Australia or New Zealand will impact U.S. exports of cheese.

Ireland has had significant success with importing Kerry Gold butter into the U.S. They are now exporting Kerry Gold cheese to the U.S. Will it capture some consumer interest? Will it be significant? Ireland is part of the EU and their country data is not not available separately.

SUMMARY

So how does the future look for balancing supply and demand of producer milk? The factors involved to determine this include U.S. domestic consumption rates for fluid milk and cheese, changes in export levels of cheese, and increases in cow productivity, and increases in butterfat and milk protein component levels.

- The number of dairy cows are increasing by about one percent annually.

- Milk per cow is increasing by about one percent annually.

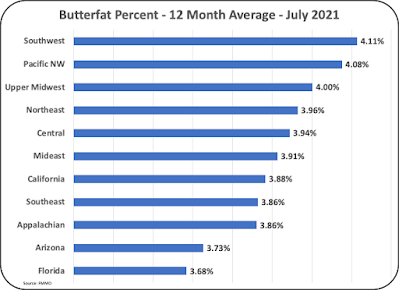

- Butterfat percent in milk is increasing by two percent annually.

- Milk protein percent in milk is increasing by one percent annually. Federal Orders with a lot of Class III milk for cheese, like the Upper Midwest, are increasing milk protein by two percent annually.

In the

May 30, 2021 post, domestic fluid milk consumption is declining by about two percent annually.

In this analysis, it appears that cheese demand will be increasing by 1.5 percent annually soon.

These numbers do not show a balance in supply and demand. If the OECD projections hold true, U.S. milk production will have to slow to match demand in the upcoming five years.