In reviewing the dairy data, it appears that there is very good news in the world for the dairy industry and cheese makers. Global demand for cheese is expected to grow very steadily for the next 10 years. The two big cheese makers, the EU and the U.S. have growing demand, but at a rate far less than the world in total. The U.S. should be in a position to take advantage of this to develop a strong export cheese business.

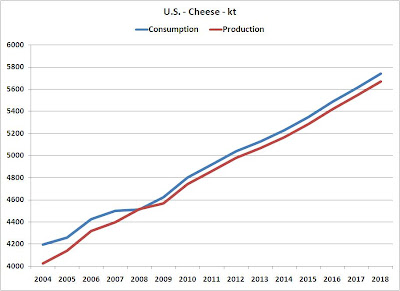

Unfortunately, the report concludes exactly the opposite! The U.S. had traditionally produced less cheese than is consumed and is therefore a net cheese importer. The exception to this was 2008 when the U.S. became a net cheese exporter.

Similarly, the 27 countries of the EU, while remaining a net cheese exporter, are actually predicted to export less cheese.

There is however, one country that is poised to significantly increase their exports. It is New Zealand. By 2018, they are expected to export 18 times as much cheese as they consume! After a few rough years in 2005 - 2008, the New Zealand dairy industry is expected to grow at an unprecedented rate.

By 2016, the small country of New Zealand is expected to surpass the 27 countries comprising the EU in cheese exports. The U.S., after a brief period of being a cheese exporter in 2008, will become increasingly a cheese importer. Yes, a lot of those imports will come from New Zealand.

Most of the efforts of programs like the Cooperatives Working Together (CWT) program to reduce cows in the U.S. and the "Got Milk" ads just don't seem to recognize and focus on the real issue which is the global dynamics of cheese production and consumption. More and more use of dairy is in cheese rather than fluid milk products and the Federal Milk Marketing Orders (FMMO) payment is all about cheese prices. Cheese has a good shelf life and density which makes it a global exportable/importable product.

In the May 7 post to this blog, the New Zealand Dairy Industry was analyzed. The real threat to the U.S. Dairy Industry is coming from New Zealand, not from the U.S. dairy producers or U.S. consumption of dairy products. To combat these threats, they must first be recognized. Today's programs do not recognize or address the real threats to the U.S. Dairy Industry.

No comments:

Post a Comment