Compared to the prior month, the dashboard shows mostly red.

But compared to the long term trends, January prices were "normal".

Protein continues to dominate the value of milk, with "other solids" taking on an unusual significance.

The most significant input parameters for calculating milk prices, cheese, and butter prices, fell to $1.61/lb and $1.59/lb respectively. What brought these changes about? Primarily inventory changes - with butter (which has been very low) returning to more normal levels and cheese (which has been slightly high) also returning to more normal levels.

One of the significant factors driving these changes has been exports. The final export/import figures for 2011 will be available in a few weeks, and a special post reviewing these will be made at that time. Because exchange rates play a major role in the international forces that impact imports and exports, they will also be reviewed in this upcoming post.

The remainder of this post will be spent examining the parameters dealing with the supply side for the most important element in milk pricing, cheddar cheese prices.

Cheese per capita consumption has been increasing steadily for decades, so one would not expect cheese production or inventories to remain static as they must grow with the increases in consumption. However, production growth not consistent with the growth in U.S. consumption (and exports) will lead to abnormal inventory levels.

Cheese production over the last 11 years has grown in a rather predictable pattern.

But as we look more closely at the last few years, abnormal production levels can be seen. Unusually high production occurred in 2010 (when milk prices were low), and unusually low production occurred in 2011 which brought inventories back to more normal levels.

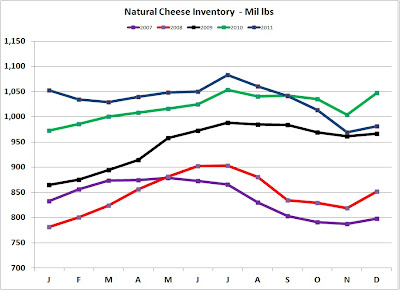

This in turn led to some unusual "blips" in cheese inventories, with inventories rising higher than normal in 2010 and early 2011, followed by a return to more normal levels by the end of 2011.

The low Class III milk prices which began in 2009 and continued in 2010 can be seen in the chart below.

The view presented above deals only with the supply side of cheese production and it's impact on inventories. That is only part of the picture. Demand side changes are also very important. While U.S. consumption is pretty predictable, exports are becoming an increasingly important part of cheese demand and they can be very volatile. As the full data for 2011 becomes available in the next few weeks, exports will be reviewed with a special post in the blog.

It is great to see the continuous increase in US cheese production. Given the still relatively untapped potential of some of the uses of milk protein and marketing its value, and the growing efficiency of the American dairy industry, I can only think that milk protein will continue to be a major player in milk pricing for years to come.

ReplyDelete