While imports of cheese were down as shown in the chart below, that change did not come close to offsetting the drop in cheese exports. Butter imports were up again. The prior post provides details on what appears to be a building bubble in butter pricing.

CHEESE

In the chart below, year-by-year comparative levels of cheese exports are graphed. A strong downward trend has been established over the last six months. This will likely continue as the factors causing the decline are still in place. Most of the losses come from the three biggest export customers, Mexico, South Korea, and Japan.

Cheese imports, although less than the prior month, are still way above historical levels. Cheese processors are discovering more low cost sources of cheese and are taking advantage of them.

Where are these imports coming from? They're coming from everywhere as many sources offer lower cost alternatives. The major growing import country is New Zealand. Taking advantage of import opportunities is how a capitalistic society works.

With 17 KMT of cheese imported in August and 23 KMT exported, the net exports amounted to only 6 KMT. This has erased the progress made in the prior four years.

As shown in the prior post, cheese inventories are on the rise as cheese production outstrips demand.

BUTTER

The butter price was described in the prior post as a bubble. Will the bubble burst? In August, butter imports increased 11.5%. Butter inventories have remained stable as reviewed in the prior post. Bubbles occur when there is a basic change in how the industry conducts business and this is the case for butter. Butter churning has been decreasing for the last three years after decades of growth. Exports are almost nonexistent. Butter imports are well above historical levels. Because consumption is growing, as the U.S. production declines, imports will continue to grow to meet the demand. Because butter is much less expensive internationally than in the U.S., if nothing changes, the U.S. butter price bubble will burst. The only question is when.

Who is supplying this imported butter? As shown in the chart below, Mexico is the by far the largest source and a new import player. Also, Australia and Canada are new sources. Butter imports from Ireland, New Zealand, and France are not new, but they are significantly expanded.

Primarily due to escalating imports, the U.S. is now a net butter importer.

NONFAT DRY MILK AND DRY WHEY

The final two commodities that determine milk prices are nonfat dry milk and dry sweet whey. Like cheese and butter, exports of these items are also off. NDM exports did make a slight improvement over the prior month, but YTD exports are off 6%. NDM is the basis for pricing Class IV milk.

Dry whey exports are off 18% YTD and have been at or below the prior year for all of 2015. Dry whey is primarily an export item and the lack of exports has reduced the price considerably. The Dry whey price is the basis for pricing "other solids" in the component pricing Federal Orders.

EXCHANGE RATES

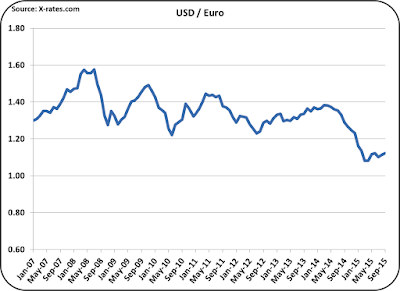

Exchange rates continue to make exports difficult. Europe's economy continues to slowly improve. The USD/Euro exchange has now stabilized and is showing signs of a strengthening Euro. However, for now, exchange rates do give the huge European dairy industry a pricing advantage.

U.S. imports from New Zealand have increased dramatically. Fonterra, the sales and marketing cooperative of the New Zealand dairy industry has been very effective in promoting New Zealand's dairy products. Fonterra has offices around the world including offices and labs in the U.S. Recently, due to the aggressive growth program supported by Fonterra investments, their credit rating has been downgraded. Regardless, Fonterra is a strong force to be reckoned with internationally. Shown below is the exchange rate between the USD and the NZD. The USD continues to strengthen relatively making the prices for New Zealand dairy products lower on the international markets.

Mexico is the largest importer of U.S. dairy products. The NAFTA agreement prevents unfair tariffs and unfair limitations of movement of dairy products between the U.S. and Mexico. Mexico has a cheese deficiency and is by far the U.S.'s best customer for cheese. However, exchange rates are increasingly making U.S. dairy products more expensive in Mexico and are making Mexican produced dairy products less costly to import. Mexico does have alternatives sources for unbranded dairy products.

Little seems to be happening that could change the export/import picture in the short term. For this reason, U.S. dairy prices are more likely to fall than rise in the next six months.

No comments:

Post a Comment