The cheese prices fell slightly to $1.75/lb. but continued near the 2016 high point established last month. The price level for the last two months reflects a price not seen for cheese since January, 2015. The relatively stable cheese price and the lower butter price brought the current prices for components more in line with the long-term trends. Protein held its value while butterfat fell. Cheese prices are the primary determinant of the Class III milk price and butter prices shift value between butterfat and milk protein. The math behind these relationships was reviewed in the prior posts listed below.

"Is Milk Pricing really tied to Cheese Prices?"

"The Math behind Milk Protein and Butterfat Pricing"

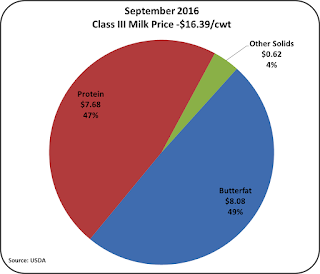

The pricing for milk protein and cheese also brought the pie of components back to a more normal relationship with milk protein contributing 47% of the value to the Class III price. Butterfat retained its strong share of the pie chart, above historical proportions.

Nonfat dry milk prices were up 5% at $.89/lb., a high for 2016. This will increase the price of Class II and IV milk, but it is not enough to make it become the basis of the Class I milk price. The current price will increase the uniform price slightly and provide a higher Producer Price Differentials. While a lot of NDM was exported in August, it was sold at a low price, keeping the Class IV price well below the Class III price. For more detail on how NDM prices can be a major influence on Uniform milk price, see this prior blog post.

Imports and exports are the most volatile component of demand for U.S. produced dairy products. The most recent data on exports shows strong volumes of exports. However, exports in August were strong in volume, not dollars, and were driven by strong exports of NDM. A review of the data shows that exports of cheese and butter remained very low and the NDM was sold are low prices. While there has been recovery in overall export volume, it has not had an impact of the key items important to domestic dairy producer prices.

However, there is encouraging data in the developing prices of the key dairy exports. The higher U.S. prices for cheese and butter have made exports difficult and imports more attractive. While the dairy export and import volumes are always a month behind in availability, international prices are available almost immediately. The comparative pricing is encouraging. The international prices for cheese are at almost identical prices for Europe, Oceania, and the U.S. The price for SMP is also nearly equal for all the major competitors. Butter pricing is mixed as European butter has increased in price, but Oceania butter is still well below U.S. prices. That should play into improved exports and fewer imports. In all cases, the leveling of prices is a combination of lower U.S. prices and higher prices for the other international dairy exporters.

In addition to the lag in the data for exports and imports, there is an additional lag in the process for international purchases and shipments, there appears to be a developing competitive environment favorable to U.S. exports, but it will probably take the rest of 2016 to more fully develop. Given time, this should have a favorable impact on U.S. dairy prices.

CHEESE

Inventories of domestic cheese showed a favorable trend in August. After a build-up of cheese inventories in the first seven months of 2016, inventories fell a little in August. While this is normal pattern for August, it is a positive step toward bringing cheese inventories more in line.

There was also a reduction in cheese production in August which was also an encouraging analytic in reducing cheese inventories.

However, there was little help from exports/imports in August. Exports were down and imports were up resulting in a decline in net exports.

BUTTER

Butter inventories continue to remain high and prices continue to fall. Butter churning fell in August, but imports continued to grow. Butter is being imported in increasing quantities from Ireland, Mexico, and New Zealand.

The market indicators are certainly mixed and that makes future pricing and timing difficult to access. There is an abundance of news that global dairy markets are correcting. However, there are still excesses that must be reduced before market forces are in balance. The futures market is predicting lower milk prices in the near future. The recovery that is starting to take place is progressing slowly. The impact of trade agreements and harmonization of global dairy standards presents another dynamic that is difficult to predict. (See the two prior posts - September 18 and October 2, 2016 - for some additional detail of trade agreements.) Overall, it appears that recovery of producer milk prices will be slow and volatile.

No comments:

Post a Comment