January 2017 Class and Component milk prices were

announced on February 1. The Class III price was down 3.6% to $16.77/cwt.

The decline was the result of a drop in cheese prices as inventories

increased. Butter, NDM, and dry whey prices increased. However, the

increases in three of the four commodities that determine milk prices were not

enough to outweigh the dominance of the drop in cheese prices. (See this blog post for an

analytical explanation of the cheese price/ Class III price relationship.)

Component price changes were more dramatic.

Butterfat increased in value by 8.1%, Other Solids increased in value by

21.3%, but milk protein dropped by 19.1%. The drop in the price of milk

protein resulted from both the decreased price of cheese and the increased

price of butter. As shown in the chart below, both components that make

up the formula for pricing milk protein had a negative influence in January.

This has shifted the financial contribution of

milk protein and butterfat. Butterfat is now contributing 53% to the

Class III milk price. Milk protein is now contributing a lower value

making up 39% of the Class III price. To compare this to the prior month,

refer to the January 8 post to this blog.

This has also influenced the long-term trends.

Butterfat is now worth more at $2.53/lb. compared to milk protein at

$2.18/lb. Other Solids continued its gain reaching $.25/lb., a higher

price than seen in all of 2016. The price of other solids is based on the

price of dry whey, which is primarily an export item. More data on this

is covered later in this post.

The increased butter price is influencing the

above trends. The butter price chart shown below has five years of data.

While butter is again over $2/lb. it is still far from the peak prices

reached in 2014 and 2015. The price of butter has seen a gradual increase

starting in 2010. Initially this looked more like a normal fluctuation,

not a trend. However it is now clearly a trend, increasing from around

$1.50/lb. in 2014 to around $2.00/lb. in 2016/7. If consumer consumption

of butter continues to grow, butter prices will likely continue this increase.

A review of inventory levels does raise some

concern. Inventories of cheese rose in December after four months of

declines as shown in the chart below.

Cheese inventories do increase with the

long-term trend of increased U.S. per capita consumption of cheese and population growth.

Cheese exports grew significantly since 2010, but declined starting in

2015. The pace of production of production has increased steadily in

spite of the decline of in exports.

The chart below shows that starting in 2015, as

exports declined, cheese inventories have been above the normal growth trend line.

This is causing a bubble in inventories that is weighing on cheese

prices. This is especially concerning because the Class III milk price is

extremely dependent on cheese prices. Because of the longer shelf like of

cheese vs. other dairy products, excess milk production can be temporally

housed in cheese inventories. However, as cheese inventories rise, prices do decline.

Butter inventories are also increasing as shown

in the year-to-year comparison below. However, this increase is not out-of-line

considering the increased per capita consumption. Because U.S. butter

prices are well above international butter prices, exports are nil.

Production of butter has been on a decline for

the last four years. Imports of butter have been making up for the

deficit. More on this somewhat unusual situation will be covered in the

next blog post when December export data is available.

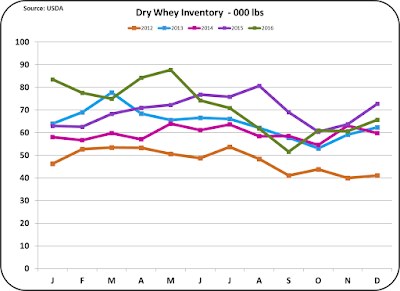

Inventories of dry whey and nonfat dry milk,

both major export items, have remained at appropriate levels. Exports

have remained strong and January 2017 prices for both products are will above

2016 prices. As mentioned above, dry whey is the basis for other solids

pricing. The current price is well well below 2012 to 2014 pricing, but is

increasing. There is an interesting article in the current dairy exporter blog, citing

the increased global demand for whey protein. Dry whey does have a

reputation for being a good source of dairy protein. However, whey

protein represents only about 18% of the protein in milk, with the rest going

into cheese. Dry whey is primarily lactose.

Nonfat dry milk exports have remained very

strong. Pricing has been poor, but it is increasing. As a result,

inventories have remained at very acceptable levels.

While exports of dry whey and NDM remain strong,

there is concern that the very strong USD will keep prices below the high

levels seen in prior years. More will be examined on this in the next

post that will cover dairy exports for the full year of 2016.

No comments:

Post a Comment