This Post will cover the trends in sales of fluid (drinking) milk in the U.S. This is an update from the February 21, 2021 post to this blog.

Fluid milk sales have been declining at about two percent annually prior to 2020. In 2020, there was a significant increase in milk consumption as eating habits were formed around the "Stay at Home" mandates implemented with COVID. In 2021, sales are again falling into the long-term declining trends. Most of the data in this post is based on 12-month averages to reduce short-term fluctuations and better define long-term trends.

|

| Chart I - Total Fluid Milk Sales |

Chart II below expresses the annual changes as a percent. As mentioned above, prior to COVID, fluid milk sales were averaging around a two percent annual decline. In 2020 the decline slowed to near "0" and two months in 2020 even provided positive increases. However, by 2021, a significant decline began again. While the decline is currently averaging around four percent annually, some of that can be attributed to the inflated numbers from the prior year.

|

| Chart II - Milk Sales - Percent change from Prior year |

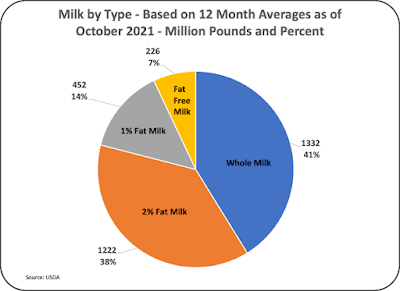

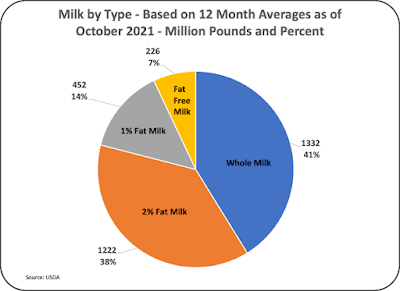

As of October 2021, the pie chart below illustrates the split between whole milk, two percent fat milk, one percent fat milk, and fat free milk. Whole milk and two percent fat milk are nearly the same size. One percent fat and fat free milk are much smaller and declining faster.

|

| Chart III - Current Milk Sales by Type of Milk |

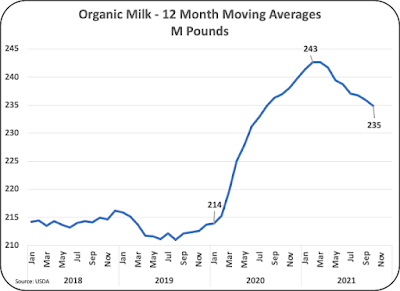

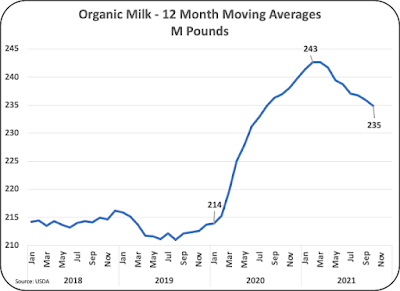

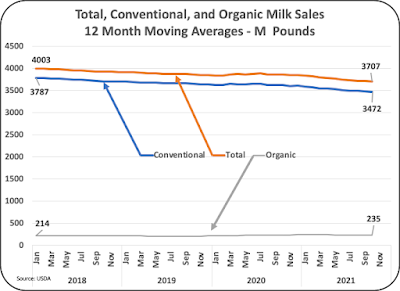

In the April 25, 2021 post to this blog entitled "The Amazing Success of Organic Milk," organic milk showed significant growth. During the pandemic, the growth increased to new record highs, reaching a 12 percent increase over the prior year based on the 12-month average data. It has recently started declining in 2021, but not as fast as conventional milk.

|

| Chart IV - Organic Milk Sales |

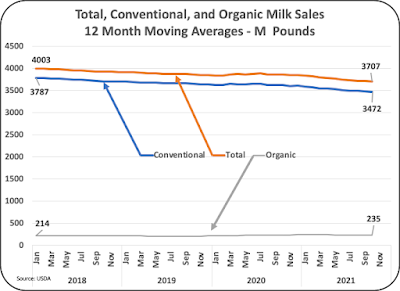

To put this in perspective, Chart V shows the comparison between conventional and organic milk. Conventional milk sales have continued to decline, and organic milk sales show an increase over the span of this chart. However, organic milk is still a niche product making up only six percent of total milk sales. However, this is a half percent increase from early 2018 when organic milk made up about 5.4 percent of the total milk consumed.

|

| Chart V - Conventional and Organic Milk Sales |

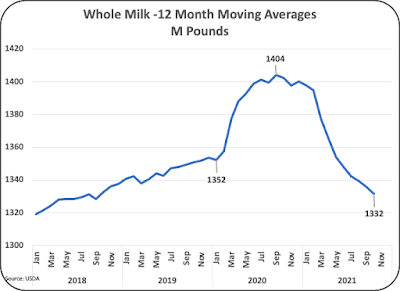

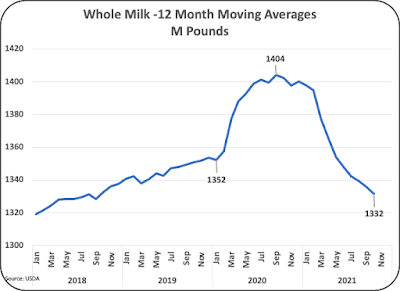

Charts VI through IX show the growth by type of milk. The charts for whole milk and two percent milk show the 2020 growth during the pandemic followed by a steep decline in 2021. However, there is one big difference. Whole milk, Chart VI, had been increasing in volume prior to the pandemic, but it is now falling below pre pandemic levels. Two percent milk, Chart VII, appears to have returned to the pre pandemic declining levels.

|

| Chart VI - Whole Milk Sales |

|

| Chart VII - Two Percent Fat Milk Sales |

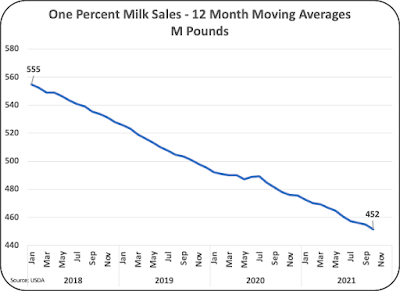

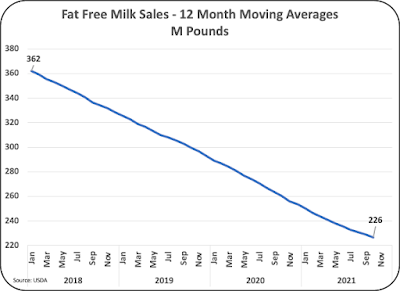

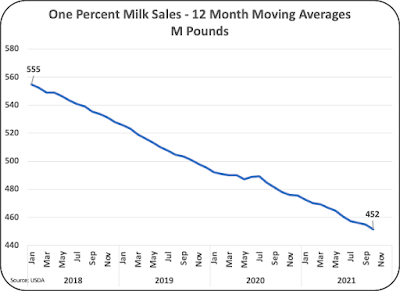

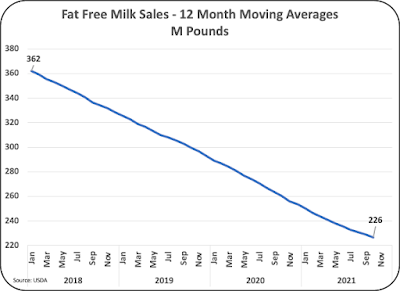

One percent fat milk, Chart VIII, and fat free milk, Chart IX, show very little impact from the COVID pandemic. Both continued their declines. One percent milk is continuing a decline of nearly five percent annually and fat free milk is continuing at a near 10 percent annual decline.

|

| Chart VIII - One Percent Fat Milk Sales |

|

| Char IX - Fat Free Milk Sales |

Many people have been strongly wishing for a return to normal following COVID. It appears that this is happening with fluid milk products. The deep declines in 2021 are partially compensating for the increases in 2020. The long-term trends of a two percent annual decline appear to be holding, with one percent and fat free milk taking major reductions.

What will 2022 bring? It appears that the percent declines in 2022 may be bigger than two percent as the impact of COVID mandates continue to decrease. The continuing trends will be followed in this blog.

With milk production increasing, fluid sales in decline and exports raising - does it still makes sense that the American consumer continues to pay the highest prices for milk as determined by the Federal Order system Class 1? Could you explore in a future post the notion of the American consumer subsidizing exports?

ReplyDeleteExcellent comment. I will try to cover this in an upcoming post. U.S.exports are primarily by products from cheese and butter production and priced at competitive international rates.

ReplyDelete